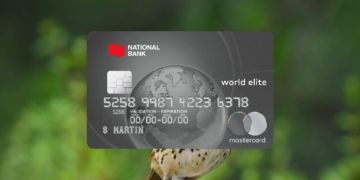

How to Apply for a National Bank Platinum Mastercard Credit Card

Looking to elevate your financial options? The National Bank Platinum Mastercard Credit Card might just be what you need. Offering a suite of perks tailored for savvy Canadian spenders, this card is designed to enrich both your everyday transactions and luxurious purchases.

Key benefits include access to comprehensive insurance coverage, ideal for frequent travelers, and a reward program that enhances the value of your spending. Additionally, enjoy the peace of mind that comes with enhanced security features, all while earning points for every dollar spent.

Applying for this card is a straightforward process, opening doors to a world of financial flexibility and security. In just a few steps, you can unlock premium benefits and a host of exclusive privileges that cater to your personal lifestyle and financial goals. Ready to discover how simple the application process can be? Let’s dive into the details.

Unlocking the Power of the National Bank Platinum Mastercard Credit Card

1. Comprehensive Travel Insurance

The National Bank Platinum Mastercard Credit Card offers an extensive range of travel insurance benefits. Cardholders can enjoy emergency medical insurance coverage up to $5 million, ensuring peace of mind wherever you go. This can be a crucial safety net for frequent travelers and families exploring both local and international destinations. Additionally, trip interruption, cancellation, and flight delay coverage can protect you from unforeseen mishaps.

Tip: Make sure to read the terms and conditions of the travel insurance policy to understand the extent of the coverage provided.

2. Reward Points for Everyday Purchases

With every purchase made using the National Bank Platinum Mastercard Credit Card, cardholders earn reward points that can be redeemed for various perks, including travel, merchandise, and even financial products. With a flexible rewards program, you can tailor your spending habits to maximize your benefits.

Tip: Use your card for groceries, gas, and recurring bills to accumulate points faster and redeem them for travel or electronics!

3. Purchase Protection and Extended Warranty

Enhancing your shopping experience, the National Bank Platinum Mastercard provides purchase protection against theft and damage for most items purchased with the card. Moreover, it offers an extended warranty on eligible products, giving you added confidence when making significant purchases.

Tip: Document your purchases and keep receipt copies to streamline the process if you need to file a claim.

4. Access to Exclusive Events and Offers

Cardholders can indulge in exclusive experiences that the National Bank Platinum Mastercard Credit Card offers. From VIP event invitations and private sales to travel offers, this card ensures you have access to unique opportunities.

Tip: Regularly check your credit card notifications and the National Bank’s website for exclusive offers and invitations.

5. Security Features and 24/7 Customer Support

Security is paramount, and this card provides cutting-edge features such as zero liability fraud protection and 24/7 customer support. These security measures ensure that you can shop and travel with confidence, knowing your financial data and transactions are protected.

Tip: Immediately report any suspicious activity or unauthorized charges to take advantage of the zero liability fraud protection.

SIGN UP TO GET YOUR NATIONAL BANK PLATINUM MASTERCARD CREDIT CARD

| Category | Benefits |

|---|---|

| Rewards Program | Earn points on every purchase, which can be redeemed for travel, merchandise, or cash back. |

| Purchase Protection | Enjoy insurance on purchases against loss, theft, or damage, providing peace of mind. |

The National Bank Platinum Mastercard Credit Card opens the door to exciting financial opportunities. Its robust rewards program allows cardholders to accumulate points effortlessly, turning everyday spending into valuable rewards. With a range of redemption options, including travel, merchandise, and cash back, users can tailor benefits to their preferences. Additionally, the card offers comprehensive purchase protection, safeguarding valuable items from unforeseen events. This feature not only enhances financial security but also adds a layer of confidence to shopping. Exploring these advantages positions cardholders to maximize their financial journeys, leading to informed decisions and tailored experiences.

Requirements to Apply for National Bank Platinum Mastercard Credit Card

- To qualify for the National Bank Platinum Mastercard Credit Card, applicants must have a minimum annual income of at least CAD $15,000. This ensures the cardholder can manage credit responsibly and meet payment obligations.

- A Canadian residency status or citizenship is necessary to apply. This requirement is in place to ensure that the cardholder has a verifiable address within Canada, which is essential for communication and account management.

- Applicants should possess a decent credit score to be considered eligible for this card. Typically, a score of 650 or above may be deemed acceptable by most Canadian banks.

- Proof of identity is mandatory, and it includes documents like a valid Canadian driver’s license or passport to confirm your identity securely.

- Additionally, individuals must submit financial documentation, such as a recent pay stub or bank statement, to verify their income and financial stability.

SIGN UP TO GET YOUR NATIONAL BANK PLATINUM MASTERCARD CREDIT CARD

How to Apply for the National Bank Platinum Mastercard Credit Card

Step 1: Visit the National Bank Website

Start your financial journey by accessing the official National Bank of Canada website. Whether you’re searching for superior travel benefits or exclusive insurance coverage, the National Bank Platinum Mastercard Credit Card offers a plethora of advantages tailored to your needs. Navigate through the site to the Credit Cards section. Here, you’ll uncover a world of options and can select the Platinum Mastercard for detailed information.

Step 2: Review Card Details and Eligibility

Dive into the detailed description of the Platinum Mastercard to understand all the benefits, such as travel insurance, purchase protection, and the ability to earn points. It’s crucial at this stage to check the eligibility criteria—age, residency status, and income requirements—that align with Canadian regulations. Ensuring you meet these prerequisites sets a solid foundation for your application success.

Step 3: Complete the Application Form

Click the ‘Apply Now’ button, which will direct you to the application form. Here, you’ll need to input personal details such as your full name, contact information, and financial status. Pay attention to each section, ensuring all information is accurate. It might require you to provide documents verifying your identity and income, so have these ready to expedite the process.

Step 4: Submit Your Application

Once your form is ready, a quick review can make the difference. Check that all fields are filled correctly before striking the ‘Submit’ button. A sense of anticipation may accompany this action as you wait for the bank’s response, usually communicated via email. This step marks your active move towards elevating your financial status with a reputable credit card.

Step 5: Receive Your Card Approval Decision

With your application in, the waiting game begins. Approval usually hinges on meeting the eligibility criteria and your financial standing. Upon approval, the card will be dispatched to your address. If you encounter any hiccups, the bank’s customer service is at your disposal to provide guidance and answer any queries.

GET YOUR NATIONAL BANK PLATINUM MASTERCARD CREDIT CARD THROUGH THE WEBSITE

Frequently Asked Questions about the National Bank Platinum Mastercard Credit Card

What are the key benefits of the National Bank Platinum Mastercard Credit Card?

The National Bank Platinum Mastercard Credit Card offers a range of benefits tailored to the needs of discerning cardholders. Perhaps most notably, it features comprehensive travel insurance, including trip interruption and cancellation protection, as well as coverage for lost or stolen luggage. Additionally, cardholders gain access to exclusive Mastercard experiences, such as luxury hotel upgrades and unique culinary events. The card also provides the advantage of earning rewards points, which can be redeemed for travel, gift cards, or even credited toward your balance.

What are the eligibility criteria to apply for this credit card?

To qualify for the National Bank Platinum Mastercard Credit Card, applicants must meet certain criteria, including being a resident of Canada, possessing a good credit score, and providing proof of income. Typically, a minimum annual income requirement is in place, which ensures the cardholder can sustain the benefits and perks the card offers. It’s advisable to check directly with National Bank for the most up-to-date and detailed eligibility requirements.

Are there any annual fees associated with the card?

Yes, the National Bank Platinum Mastercard Credit Card typically carries an annual fee. However, the comprehensive suite of benefits and rewards offered may justify this fee. Often, promotions might waive the fee for the first year or provide additional incentives for new cardholders. It’s wise to factor in these costs and the accompanying benefits when deciding if this card aligns with your financial pursuits.

How does the rewards program work?

The rewards program associated with the National Bank Platinum Mastercard Credit Card is designed to benefit frequent spenders. Points accumulate for every dollar spent on eligible purchases, with extra points earned for spending within specific categories like travel or dining. These points can be redeemed for a variety of rewards, including travel, merchandise, or gift cards, offering flexibility to the cardholder. For those looking to maximize their gains, understanding the rewards categories where points accumulate faster is key.

What should I know about the interest rates?

This credit card features rates competitive with those in the current market. However, it’s crucial to be aware of the card’s distinct interest rates on purchases, balance transfers, and cash advances. Typically, the purchase interest rate might be lower, but exact rates can vary based on factors such as creditworthiness at the time of application. Remaining mindful of these charges is essential for managing finances effectively. Before applying, consider reviewing the most current rates and any possible overdraft fees.

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the Centralismo platform. Her goal is to provide readers with practical advice and strategies for financial success.